This text was obtained via automated optical character recognition.

It has not been edited and may therefore contain several errors.

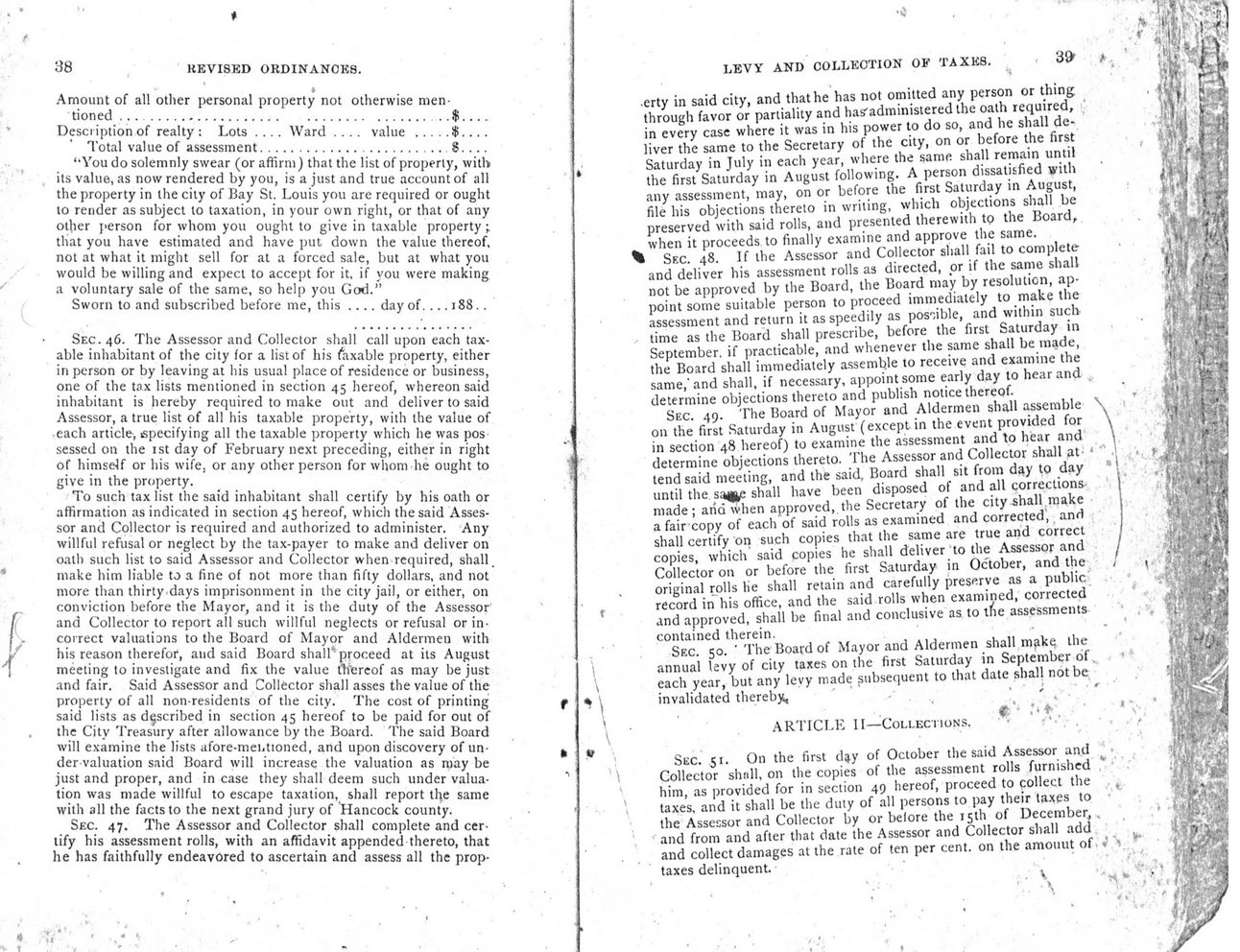

30 KEVI8ED 0KDINANCK8. » Amount of all other personal property not otherwise mentioned .................................................. Description of realty : Lots .... Ward .... value ...........$..,. Total value of assessment.............................. 8.... ‘•You do solemnly swear (or affirm) that the list of properly, with its value, as now rendered by you, is a just and true account of all the property in the city of Bay St. Louis you are required or ought lo render as subject to taxation, in your own right, or that of any other person for whom you ought to give in taxable property that you have estimated and have put down the value thereof, not at what it might sell for at a forced sale, but at what you would be willing and expect to accept for it, if you were making a voluntary sale of the same, so help you God.” Sworn to and subscribed before me, this .... day of.... 188., Sec. 46. The Assessor and Collector shall call upon each taxable inhabitant of the city for a list of his (axable property, either in person or by leaving at his usual place of residence or business, one of the tax lists mentioned in section 45 hereof, whereon said inhabitant is hereby required to make out and deliver to said Assessor, a true list of all his taxable property, with the value of each article, specifying all the taxable property which he was pos sessed on the 1st day of February next preceding, either in right of himself or his wife, or any other person for whom he ought to give in the property. To such tax list the said inhabitant shall certify by his oath or affirmation as indicated in section 45 hereof, which the said Assessor and Collector is required and authorized to administer. Any willful refusal or neglect by the tax-payer to make and deliver on oath such list to said Assessor and Collector when required, shall, make him liable to a fine of not more than fifty dollars, and not more than thirty days imprisonment in the city jail, or either, on conviction before the Mayor, and it is the duty of the Assessor and Collector to report ail such willful neglects or refusal or incorrect valuations to the Board of Mayor and Aldermen with his reason therefor, and said Board shall'proceed at its August meeting to investigate and fix the value thereof as may be just and fair. Said Assessor and Collector shall asses the value of the property of all non-residents of the city. The cost of printing said lists as described in section 45 hereof to be paid for out of the City Treasury after allowance by the Board. The said Board ■will examine the lists afore-mei.tioned, and upon discovery of undervaluation said Board will increase the valuation as may be just and proper, and in case they shall deem such under valuation was made willful to escape taxation, shall report the same with all the facts to the next grand jury of Hancock county. Sec. 47. The Assessor and Collector shall complete and certify his assessment rolls, with an affidavit appended thereto, that he has faithfully endeavored to ascertain and assess all the prop- LEVY AND COLLECTION OF TAXES. < 39' t •erty in said city, and that he has not omitted any person or thing through favor or partiality and has'administered the oath required, in every case where it was in his power to do so, and he shall deliver the same to the Secretary of the city, on or before the first Saturday in July in each year, where the same shall remain until the first Saturday in August following. A person dissatisfied with any assessment, may, on or before the first Saturday in August, file his objections thereto in writing, which objections shall be preserved with said rolls, and presented therewith to the Board, when it proceeds to finally examine and approve the same. % Sec. 48. If the Assessor and Collector shall fail to complete and deliver his assessment rolls as directed, or if the same shall not be approved by the Board, the Board may by resolution, appoint some suitable person to proceed immediately to make the assessment and return it as speedily as possible, and within such time as the Board shall prescribe, before the first Saturday in September, if practicable, and whenever the same shall be made, the Board shall immediately assemble to receive and examine the same,'and shall, if necessary, appoint some early day to hear and determine objections thereto and publish notice thereof. Sec. 49. The Board of Mayor and Aldermen shall assemble on the first Saturday in August (except in the event provided for in section 48 hereof) to examine the assessment and to hear and determine objections thereto. The Assessor and Collector shall attend said meeting, and the said, Board shall sit from day to day until the saqy; shall have been disposed of and all correclions-made; and when approved, the Secretary of the city shall make a fair copy of each of said rolls as examined and corrected’ and shall certify on such copies that the same are true and correct copies, which said copies he shall deliver to the Assessor and Collector on or before the first Saturday in October, and the original rolls he shall retain and carefully preserve as a public record in his office, and the said rolls when examined, corrected and approved, shall be final and conclusive as to tfie assessments contained therein. Sec. 50. ’ The Board of Mayor and Aldermen shall make the annual levy of city taxes on the first Saturday in September of each year, but any levy made subsequent to that date shall not be invalidated thereby, ' ' , • ARTICLE II—Collectionrs. * ’ Sec. 51. On the first djy of October the said Assessor and Collector shnll, on the copies of the assessment rolls furnished him, as provided for in section 49 hereof, proceed to collect the taxes, and it shall be the duty of all persons to pay their taxes to the Assessor and Collector by or belore the 15th of December, and from and after that date the Assessor and Collector shall add and collect damages at the rate of ten per cent, on the amouut of taxes delinquent. . V . \

BSL 1880 To 1899 the-Charter-City-of-Bay-St-Louis-19mar1886-(19)